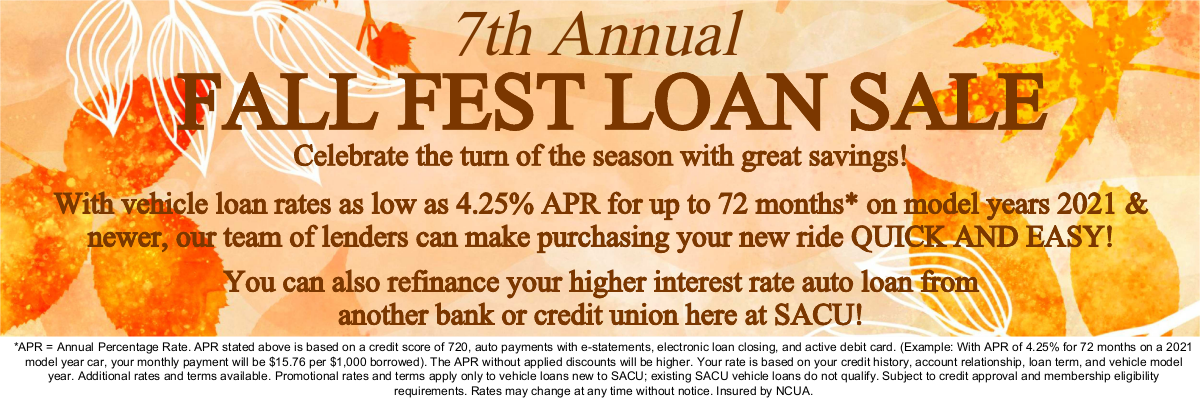

Need to refinance your auto loan? We do that too! Apply today to see how much you can save!

Applying for a loan online is secure, fast, and easy.

Contact our lending department at (920)459-5154 to discuss loan options!

Consumer Loans

Whatever car you're dreaming of, we'll help put it in your driveway.

Whether it's that bright red sports car or a crossover for family adventures—or even your very first car ever—SACU can help get you behind the wheel. We've got great rates for new or used vehicle loans, and we can lend up to 115% of the retail value of your vehicle.

Optional payment protection if you become sick or injured

Optional GAP protection - if your vehicle is in an accident and you owe more than the value, the difference is covered by GAP

Optional mechanical Repair Coverage

Apply online and get pre-approved financing before you visit the dealership. Avoid the hassle of negotiating over financing so you can concentrate on finding the vehicle you want!

Purchasing your new or used RV, camper, boat, ATV, snowmobile, or UTV? SACU can pre-approve your loan before you shop!

Looking to refinance your current loan for a lower rate? Apply today and see how much you could save!

Contact us at (920) 459-5154 to discuss loan options.

New or Used Recreational Vehicles - Motorhomes, Boats, Campers, Snowmobiles, ATVs (2019 and Newer)

| Term | Monthly Payment** | APR* As Low As |

|---|---|---|

| 24 Months | $ | |

| 36 Months | $ | |

| 48 Months | $ | |

| 60 Months | $ | |

| 72 Months | $ | |

| 60 Months Balloon*** up to 15 yr amortization |

$ |

Used Recreational Vehicles - Motorhomes, Boats, Campers, Snowmobiles, ATVs (2018 and Older)

| Term | Monthly Payment** | APR* As Low As |

|---|---|---|

| 24 Months | $ | |

| 36 Months | $ | |

| 48 Months | $ | |

| 60 Months | $ | |

| 36 Months Balloon*** up to 15 yr amortization |

$ |

*APR is Annual Percentage Rate.

**Monthly payments are based on payment per $1000 for the terms noted and the lowest rate available.

*** Balloon terms available for loan amounts $25,000 or greater.

Rates posted based on excellent credit and having three qualifying services. Rates as of 6/03/2025 and are subject to change without notice. Your actual loan amount, rate and term is based on your credit history and credit score, and age of collateral.

NEW REWARDS CREDIT CARDS AVAILABLE

Choosing the right credit card is easier than ever. Whether you want to pay down balances faster,

maximize cash back, earn rewards, or begin building your credit history, we have the ideal card for you!

No matter which card you choose, you'll enjoy important features like:

Convenient and flexible purchasing power. Accepted at millions of locations worldwide.

Mobile Purchasing capability for added convenience.

Zero Fraud Liability*. You won't be liable for fraudulent purchases when your card is lost or stolen.

Cardmember Service available 24 hours a day/365 days per year.

Plus, much more!

*Elan Financial Services provides zero fraud liability for unauthorized transactions. Cardholder must notify Elan Financial Services promptly of any unauthorized use. Certain conditions and limitations may apply. The creditor and issuer of these cards is Elan Financial Services, pursuant to separate licenses from Visa U.S.A. Inc., and Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

If you need extra cash—for whatever reason—our Personal Loans can offer the funds you need at rates you can afford. Or Fixed Rate Kwik Cash Line of Credit to have available when needed.

Personal loans, with a fixed interest rate, are available for a wide variety of purposes, such as vacations, computer equipment, household goods, appliances, taxes, school shopping, etc.

Kwik Cash Consumer Line of Credit (available when you need funds) - Get a FIXED Interest Rate on a line of credit (able to transfer funds to checking or savings account with online (home) or mobile banking - EASY access!)

Debt Consolidation to help pay off high interest rate credit cards that usually have an interest rate that changes, medical bills, etc.

Many other purposes - JUST ASK!

Personal Loans Rate

| Term | Monthly Payment** | APR* As Low As |

|---|---|---|

| 36 Months | $79.85 | 9.30% |

*APR is Annual Percentage Rate.

**Monthly payments are based on payment per $2500 loan amount (up to 36 months for $2,500 or greater, other terms available based on loan amount) and the lowest rate available. Rate posted based on excellent credit and auto payment and electronic signing with estatements. Rate as of 6/03/2025 and are subect to change without notice. Your actual loan amount, rate and term is based on your creditworthiness and qualifying services.

Home Improvement Unsecured Loan (Personal Loan)*

| Term | Monthly Payment** | APR* As Low As |

|---|---|---|

| Up to 10 Years and $10,000 | $12.67 | 8.75% |

| Up to 15 Years and $10,000.01-$25,000 | $10.48 | 9.75% |

*Home Improvement Underwriting Guidelines are established by third-party program. Based on credit worthiness and income. Tax bill to verify property ownership. Check must be made to contractor or supplier.

**APR is Annual Percentage Rate. ˆMonthly payment is based on payment per $1,000 loan amount for term and APR listed

There is no predicting when the unexpected will happen. Protecting your loans or KwikCash Line of Credit is a great way to protect your wallet moving forward!

Debt Protection

Your safeguard against the unexpected! Protecting your loan balance or loan payments can help you and your family worry a little less about what happens tomorrow.

Your family means everything to you. And if the unexpected happens, you don’t want an emotionally trying situation to be compounded by financial worry. That’s why there’s Debt Protection, which may cancel your loan balance or payments in case of:

• Involuntary unemployment - a covered job loss occurs

• Disability - a covered disability occurs due to illness or injury

• Death - protected borrower passes away

It is simple to apply with your loan officer and takes effect immediately with your loan. Ask about financial protection for you and your loved ones.

Debt Protection with Life Plus

For additional protection, Life Plus can extend your Debt Protection to address a wide range of circumstances, giving you the reassurance of knowing you’ve taken steps to help secure your finances.

• Accidental dismemberment

• Terminal illness

• Hospitalization or family medical leave

• Death of a non-protected dependent

Take an important step toward financial security. Ask us about Debt Protection with Life Plus today.

Your purchase of Debt Protection with Life Plus is optional and will not affect your application for credit or the terms of any credit agreement required to obtain a loan. Certain eligibility requirements, conditions and exclusions may apply. Please contact your loan officer or refer to the Member Agreement for a full explanation of the terms of Debt Protection with Life Plus. You may cancel the protection at any time. If you cancel protection within 30 days, you will receive a full refund of any fee paid. LPS-3415689.1-0121-0423 CUNA Mutual Group ©2021, All Rights Reserved.

Gap Coverage

Closing the gap in protecting your current and future vehicle investment!

What is GAP? Guaranteed Asset Protection, or GAP, is a voluntary, non-insurance program offered as protection on a new or used vehicle that is financed or leased. It is a supplemental benefit that enhances, rather than replaces, your standard comprehensive, collision, or liability coverage. GAP waives the difference between your primary insurance carrier’s settlement and the payoff of your loan.¹

In other words, it protects the “gap” between your vehicle’s value and the amount you still owe in the case it is damaged beyond repair or stolen and never recovered.

In most circumstances, a vehicle’s value declines rapidly immediately after purchase and will continue to lose significant value during the first few years of ownership. Most insurance companies base their claim payments on the present value of your vehicle, which could mean that you would be left with a lot of money to pay out of pocket if your vehicle was totaled or stolen.

Consider this:

Your one-year-old financed vehicle is totaled beyond repair...

Your loan balance is $15,000

our insurance company settlement is $10,000

based on your vehicle’s market value $11,000

less your insurance deductible $ 1,000²

total amount you owe without GAP $ 5,500

TOTAL AMOUNT YOU OWE WITH GAP $0

Don’t forget to ask about GAP Coverage programs for your next vehicle loan with SACU!

¹ Subject to limitations and exclusions including a maximum loan-to-value limitation which may cap the benefit you receive

²Not available in NY or AK

Your purchase of GAP is optional. Whether or not you purchase this product will not affect your application for credit or the

terms of any existing credit agreement you have with us. We will give you additional information before you are required to pay

for GAP. This information will include a copy of the GAP Waiver Addendum which will contain the terms and conditions of GAP

benefit. There are eligibility requirements, conditions, limitations, and exclusions that could prevent you from receiving benefits

under the program.

Mechanical Repair Coverage

ESSENTIAL PROTECTION AGAINST COSTLY REPAIRS. Drive with confidence, knowing we’ve got your back. A breakdown can be troubling enough without the added worry of expensive repairs. SACU is pleased to bring you Mechanical Repair Coverage (MRC).

With the average cost of a car repair being more than $1,200¹, MRC helps protect your savings from the rising costs of vehicle repairs. With 3 different tiers of coverage, Platinum, Gold, and Silver, we can help you find the right coverage for your investment and budget.

Mechanical Repair Coverage may help limit unexpected, covered repair costs as your vehicle ages, potentially saving your budget from future unexpected repair costs. What’s more, it can be used at any authorized repair facility in the U.S. or Canada.

With MRC, you can enjoy many valuable benefits, among which are:

● Rental reimbursement: up to $35 per day for 5 days, 10 days for parts delay; available on the first day of a covered repair

● 24-hour emergency roadside assistance: up to $100 per occurrence; includes towing, battery jumpstart, fluid delivery, flat tire assistance, and lock-out service

● No out-of-pocket expense (except for any deductible): the administrator pays the repair facility directly for the covered repair

Speak with a loan officer today about how you can protect your loans!

¹CUNA Mutual Group data, average credit union member mechanical repair claim costs. Mechanical Repair Coverage is provided and administered by Consumer Program Administrators, Inc. This coverage is made available to you by CUNA Mutual Insurance Agency, Inc. The purchase of Mechanical Repair Coverage is optional. Be sure to read the Vehicle Service Contract or the Insurance Policy, which will explain the exact terms, conditions, and exclusions. Coverage varies by state. Replacement parts may be new, used, non-OEM or remanufactured. MRC-3415612.2-0522-0624 CUNA Mutual Group ©2022, All Rights Reserved.